The Future of Print Customer Service

Back in 2017, Harvard Business Review estimated “...the cost of a do-it-yourself [customer service] transaction is measured in pennies, while the average cost of a live service interaction (phone, email or webchat) is more than $7 for a B2C company and more than $13 for a B2B company.”

Print businesses don’t typically break down the cost per “customer interaction” in the carpeted area of their businesses. This level of detailed costing is reserved for the print manufacturing floor. I have discussed this topic widely with print business owners. They assume they have a sunk cost in head count in customer service and then return their focus to shaving off minutes in finishing or buying a press with inline finishing to increase both their capacity and profitability.

Customer service is changing because the customer is changing.

“Eighty-one percent of all customers attempt to take care of matters themselves before reaching out to a live representative,” according to the Harvard Business Review.

This of course assumes the company the customer is buying from has a way for a customer to solve their own issues. Today, with most print businesses, the only place a customer can look in order to solve their own issues is their inbox or their voicemail. Most print businesses have no self-service tools for the majority of their customers.

A print customer can’t go look at their full order history online. A print customer can’t look at all the approved artwork their print vendor has for them online. A print customer can’t download an invoice, or pay an invoice by credit card, for example. Print customers have to use full service as their only option. This means that print companies have to staff labor to answer every customer question at the cost of more than $13 per question (in 2017 dollars).

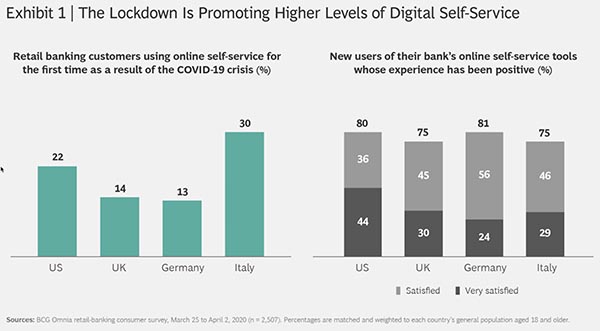

You have to have customer service, so, again, why focus on it? The global pandemic has pushed lots of customers into the digital self-service world. Think of COVID-19 as the digital laggard accelerator. All those people who insisted on walking into the bank for every transaction have now migrated to digital banking. Do you think when COVID-19 recedes, they will go back to walking into the bank? Not likely.

Your customer service team has to be working across channels, and the channel of email and phone are still relevant, but you can’t continue to resist the customer’s preference for self service. The primary reason is that you’re denying the preference of some of your customers. The secondary reason is that to remain competitive you have to be able to drive the cost per customer service transaction down.

When you integrate self-service tools into your business, your customer service team can evolve from a reactive customer service group (passively reacting to requests) to a proactive customer success team. You won’t get rid of your customer service team; you will elevate their role to be more strategic. This is critical for you and your customer service team to understand. Technology will not steal their jobs.

Without self-service tools, your customer service team doesn’t have the time to engage in “customer success”—they are too busy fielding every question from the customer. I always use the bank ATM model to help ease the fear of change in a customer service department. Customers will be able to do simple things without your help, but will still need you for the harder things. You will have more time to help your customers with the harder things, because the easier things will be off your plate.

Step back and think about your business from your customer’s perspective. If they are working from home after hours, what options do they have to engage with you? Is the only option to send an email and wait until morning? Have you created a business that only functions when fully staffed? If so, it’s time to give your customers an online channel where they can answer some easy questions and perform some simple tasks without your customer service team being directly involved.